Monetary Policy Is Best Described by Interest-rate Targets

Can be implemented quickly and most of its impact on aggregate demand occurs very soon after policy is implemented. Must be described in terms of interest-rate targets.

Monetary Policy Definition Types Examples Tools

Can be described either in terms of the money supply or in terms of the interest rate.

. Discretion Again 421 A. The money supply is increased which decreases the interest rate and causes investment spending output and employment to increase. Economics questions and answers.

If uncertainty is due to unpredictable shift of the IS curve caused by sudden and unexpected shift in private investment in fixed assets and in residential construction and. Monetary policy can be described in either terms of money supply of interest rates. Cannot be accurately described in terms of the interest rate or in terms of the money supply.

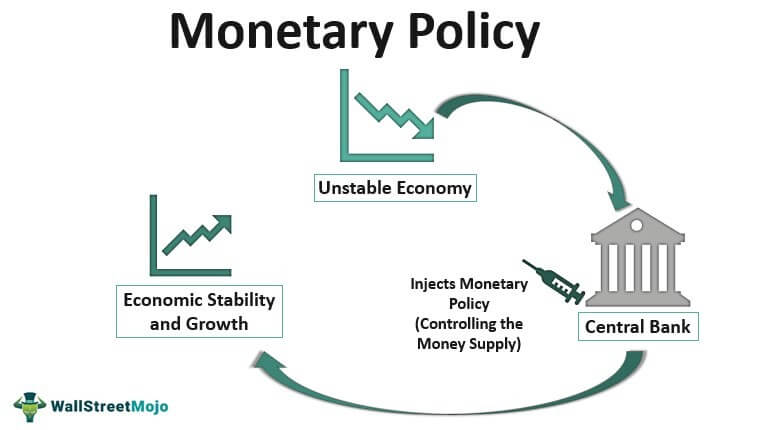

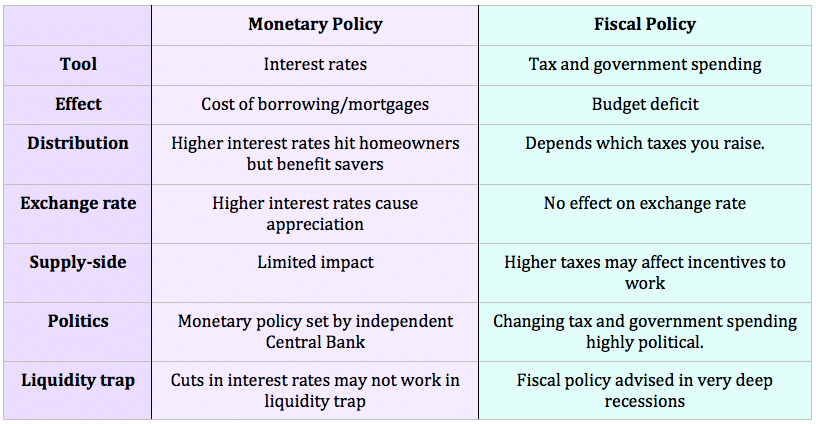

Monetary policy is a policy that a central bank of a country used to effects the economy is some way by controlling the money flow. The impact of monetary policy on the exchange rate and net exports is best described as. The rule In this context a monetary policy rule an equation that tells central bankers what interest rate policies they should put in place given employment output inflation and perhaps other macroeconomic variables.

Can be described either in terms of the money supply or in terms of the interest rate. Cannot be accurately described in. Ff t federal funds target.

Must be described in terms of money-supply targets. The interest-rate channel of monetary policy transmission appears to be. A monetary aggregate is a formal way of accounting for money such as cash or money market funds.

Whenever the money supply is increased in a country inflation also rises because the competition among the people increases to avail goods and services. 5 This consensus statement has been reviewed and updated at the Committees January meetings every year before the beginning of the current review and it. The monetary base.

Targets exchange rate targets or market interest rate targets - by varying this short-term money-market rate in an appropriate way. Can be implemented quickly but most of its impact on aggregate demand occurs months after. Possible Roles of the Yield Curve in Monetary Policy 339 Arturo Estrella and Gikas Hardouvelis The Use of Dollar Exchange Rates as Targets or Indicators for US.

The starting point for the current review is best described as a flexible inflation-targeting framework based on the 2012 Statement on Longer-Run Goals and Monetary Policy Strategy. Changes in Government Purchases 1. What is the name of the monetary policy rule that changes interest rates based on a target for the nominal GDP growth rate.

Strong because the investment component of total spending. Monetary policy Multiple Choice Identify the choice that best completes the statement or answers the question. How Fiscal Policy Influences Aggregate Demand A.

Must be described in terms of money-supply targets. The federal funds rate target was converted to a target. Steven Englander A Review of Federal Reserve Policy Targets.

Must be described in terms of money-supply targets. The Effect of Monetary Policy on Interest Rates A monetary policy that lowers interest rates and stimulates borrowing is known as an expansionary monetary policy or loose monetary policy. In the words of DC.

The Role of Interest-Rate Targets in Fed Policy 1. Flexible inflation targeting is best described as Allowing short run deviations in inflation from target to better promote output stability The Greenspan doctrine Advocates that monetary policy makers respond to asset price bubbles only in so far as it affects its price stability and output objectives The channel of monetary policy. Which of the following is the most accurate description of events when monetary authorities increase the size of commercial banks excess reserves.

Must be described in terms of money-supply targets. Conversely a monetary policy that raises interest rates and reduces borrowing in the economy is a contractionary monetary policy or tight monetary policy. To lower the interest rate is to increase the money supply.

Intermediate targets can be any economic variable that is not directly controlled by the central bank. Cannot be accurately described in terms of the interest rate or in terms of the money supply. Monetary policy Circle the ONE best answer to complete the sentence A.

Can be described either in terms of the money supply or in terms of the interest rate. Must be described in terms of interest-rate targets. The purpose of a contractionary monetary policy.

The main consideration affecting the choice between the money supply monetary aggregate target and the interest rate as an intermediate target is the uncertainty faced-by the monetary authorities. Which of the statements best describes monetary rule as proposed by the economist Milton Friedman. Must be described in terms of money-supply targets.

Must be described in terms of interest-rate targets. Thus in all three countries when meeting the monetary target has been the most pressing intermediate objective. Which of the following statements best describes the Feds new interest-rate policy.

Targets set by the Federal Reserve as part of its monetary policy goals. Must be described in terms of interest-rate targets. Must be described in terms of the gold standard.

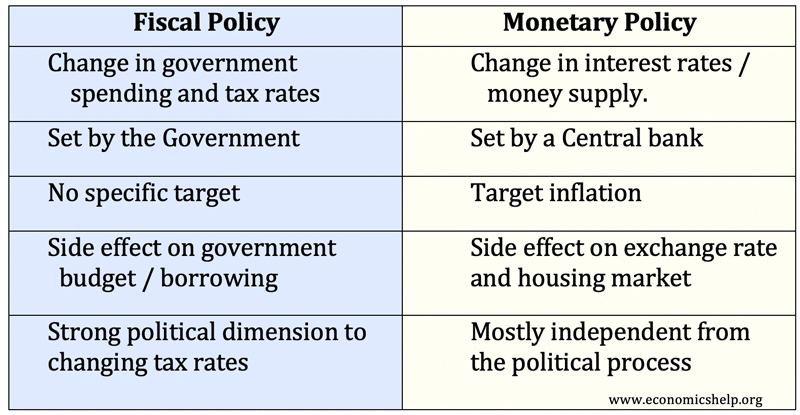

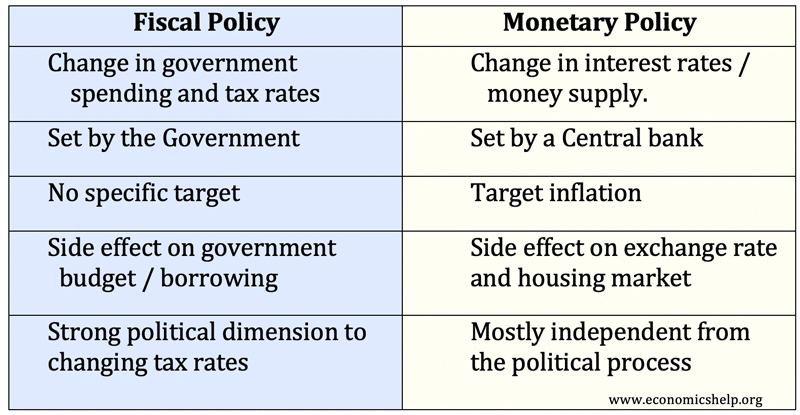

Ff t π ff r ½π gap ½Y gap where. This is often contrasted with the fiscal policy of a country. Must be described in terms of interest-rate targets.

The strongest of all the parts of the transmission mechanism. Can be described either in terms of the money supply or in terms of the interest rate. Rowan The monetary policy is defined as discretionary action undertaken by the authorities designed to influence a the supply of money b cost of money or rate of interest and c the availability of money.

Monetary aggregates are used to measure the money supply in a national economy. During the Financial Crisis of 2007-2009 the Federal Reserve changed its traditional monetary policy of targeting the federal funds rate using Open Market Operations to buy and sell US. -Fiscal policy is the best option to address a drop in factor productivity.

This memo reviews two key components of most monetary policy implementation frameworksthe interest rates IR that the Federal Reserve may wish to use as a policy rate and the operating regime OR it chooses to promote money market rate conditions consistent with the target policy rate. Monetary Policy 363 Charles Pigott and Christopher Rude Optimal Monetary Policy Design.

Uk Monetary Policy Economics Help

Difference Between Monetary And Fiscal Policy Economics Help

Comments

Post a Comment